Get a Free Web3 Marketing Proposal

A strategic Web3 marketing consultation call with an industry leader

Top Rated Web3 Marketing Services

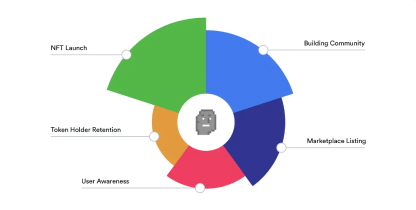

Social Media Management

The Web3 world breathes and lives on Twitter. Being part of #cryptoTwitter since 2019, we’re always at the forefront of algorithms. We have the best Degens, members and space hosts one can imagine across the industry to help your Twitter account be the talking part of the crypto town.

Social Media Management

The Web3 world breathes and lives on Twitter. Being part of #cryptoTwitter since 2019, we’re always at the forefront of algorithms. We have the best Degens, members and space hosts one can imagine across the industry to help your Twitter account be the talking part of the crypto town.

Talk to a Web3 strategist today and get featured as our next big Success!

How Blockwiz was Born

“The desperate need for strategic marketing in the web3 space is what led to the birth of Blockwiz. Now after more than 3 years, we’re one of the leading web3 marketing solutions providers.”

– Dev Sharma, CEO Blockwiz

Our Case Studies

Get the latest in Web3 Digital Marketing

The best Web3.0 marketing strategies, campaigns and industry insights

A Web3.0 Marketing Agency with a winning strategy

Define Primary Objectives

We strategically formulate result-oriented campaigns to fulfill your marketing goals within a set time frame.

Go To Market Plan

Blockwiz Web3.0 marketing experts create the perfect mix of organic and paid Web3 marketing services based on your business objectives.

Featured on

A growth marketing team that fell in love with Web3

A world-class team of data-driven digital marketers who fell in love with Web3. Our department heads are ex-entrepreneurs with million dollar exists that know how to scale projects from 0 to 1.

Our clients love working with us

Legacy Suite CEO on Blockwiz

“Exceptional service, through and through.”

– Sean Foote, CEO Legacy Suite

Work with the largest & the best Web3 marketing team on the planet!

Get the latest in Web3 Digital Marketing

Web3.0 marketing strategies, top tips and tricks to build Web3 communities and the best marketing campaigns in Web3. Curated by the team behind 350+ successful Web3 brands.

Pioneers of the Web3 Marketing revolution

- Web3.0 marketing strategies, top tips and tricks to build Web3 communities and the best marketing campaigns in Web3. Curated by the team behind 350+ successful Web3 brands.

- Around 2005, it transitioned to Web 2, a stage where customers could access material like never before through blogs and, eventually, social media.

- Now, a new internet era known as web3 has arrived as the digital age continues to advance.

- Web3 or Web 3.0 is essentially the incorporation of concepts such as blockchain technologies, decentralization, and token-based economics in the world wide web.

- And, this concept is already changing the digital marketing landscape by limiting access to user data, increasing reliability on content creators, and giving more control to consumers.

- In this way, web3 brands can be more transparent about the collection and use of consumer data, implement innovative and creative marketing strategies to reach a larger audience, and build strong communities.

A Strong Web3 Marketing Strategy that Works

- There are no intermediaries, no data thefts, no risk of server failure, and no external authorization when we talk about web3.

- All this allows projects to exploit the core aspects of web3 and incorporate a powerful marketing strategy with the help of a web3 marketing firm.

- From collaborating with popular web3 influencers to building and engaging a strong community around your project, web3 strategists at Blockwiz leave no stone unturned to ensure that you meet your set goals easily and efficiently.

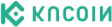

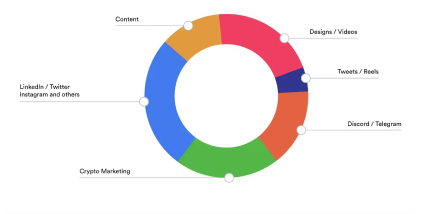

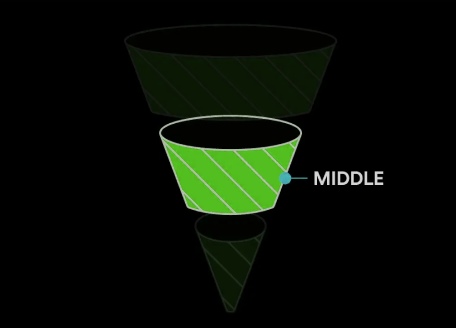

3 Funnel System We Use For All Web3 Projects

Top Funnel (TOFU)

We emphasize brand recognition and communicate specifically about how the product addresses an issue in order to connect with consumers on a personal level.

Middle Funnel (MOFU)

Users are encouraged to inquire about products, and we target the top 50% of consumers in TOF for brand recall in order to separate prospects from potential users.

Bottom Funnel (BOFU)

We tie up any loose ends in MOFU and give prospects strong brand recall in exchange for their confidence, helping them become genuine users.

Our DNA

“Creating a buzz and excitement over fake hype & shilling, documenting a moderate growth with real numbers over hyper-inflated growth with bots and building a community which incubates a brand is our way to success in Web 3.0.”

– Mohit Ahuja, Chief Solutions Officer at Blockwiz

Our Web3 Marketing Approach

The awareness phase is where we help brands share their story, mission, and vision with audiences in order to build a connection by:

- Building excitement for the upcoming launch by sharing teasers and sneak peeks of your Web3 product.

- Write about the brand’s mission and vision and share how the holders will be an essential part of it.

- Share the unique selling proposition — what makes your project and community stand out?

Consideration is the phase where we focus on building the foundation for a substantial brand recall value is done during the consideration stage by:

- Hyping up the benefits that holders will receive. Will they be invited to exclusive talks with experts? By sharing, the partnerships have already been secured.

- Using Twitter Spaces discussions to talk about topics of interest to your community. Partnering with founders from other Web3 projects in the same or similar space and expanding your communities.

- Conversion is a phase in the plan where you successfully mint out / your projects get oversubscribed:

- We focus on distribution for this stage; the more people know about your project with specific details, the better your chances for a successful mint/IDO.

- Offer loyal community members roles and exclusivity to increase conversions from members who have been engaging the brand in the awareness and consideration phase. Empower community members to become shillers.

Building a timeless community happens during the loyalty phase:

- In case of a successful launch, your floor/token price will moon, but this is the holy grail for most projects. This is where you keep building awareness on your roadmap so that the community doesn’t cash in on your project.

Result-Oriented Web3 Marketing Agency

- With our data-driven approach towards web3 marketing, Caldance was able to sell 95% of their NFT vouchers in 90 days.

- We attracted more than 250K views for XLA in just 30 days with our comprehensive web3 marketing strategies.